Compare FCPA, UKBA, SAPIN II,

China anti-corruption law

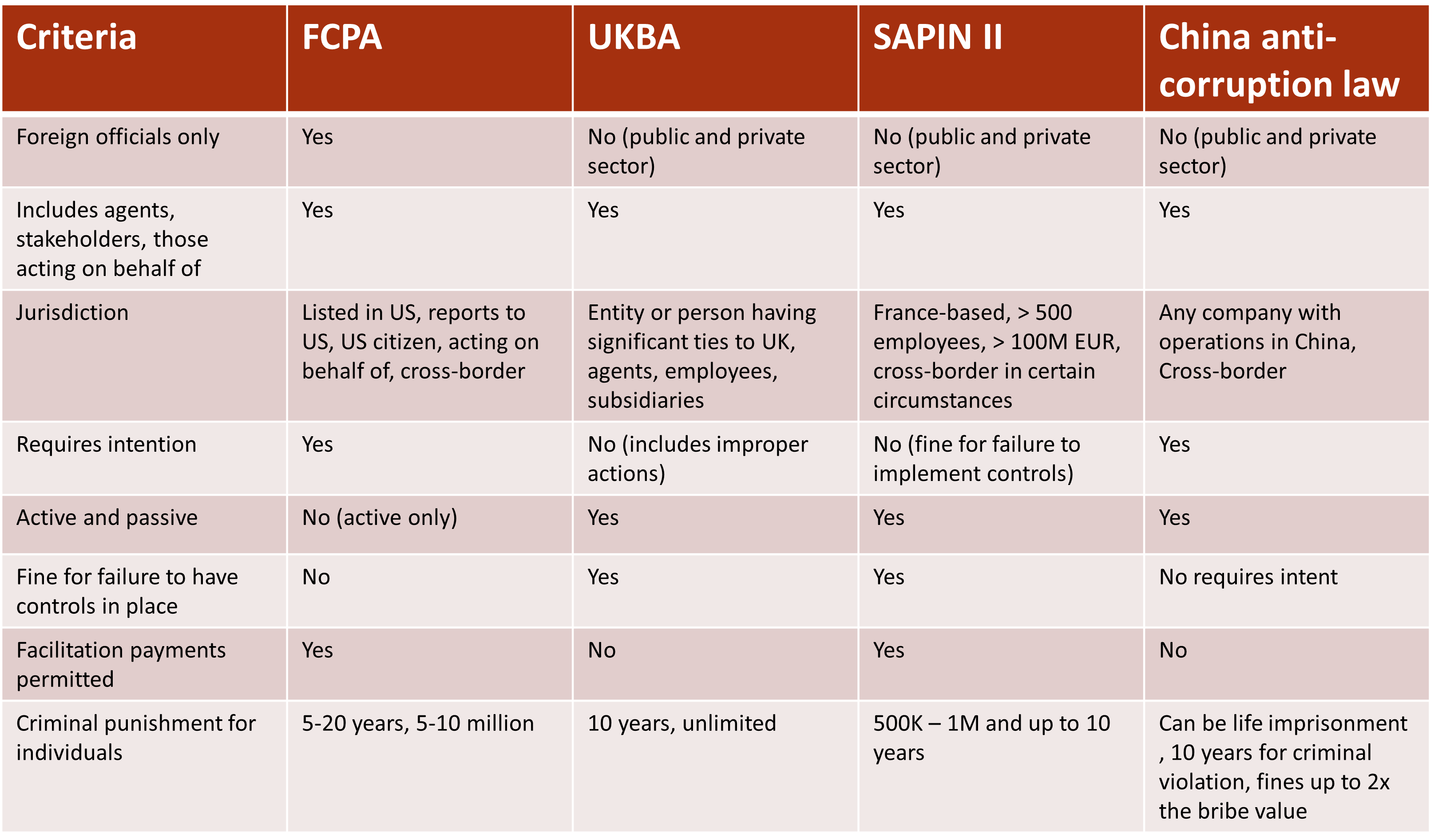

We’re talking about FCPA, UK Bribery Act, Sapin II, there’s also China Corruption Law. I just thought it’d be interesting to have one slide just to get an idea, you know, what are the differences between those things? And it is quite interesting, facilitation payments is something, for example, that is okay in the US, it’s okay for France in Sapan II, but it’s not okay for UK Bribery Act, it’s not okay for China Anti-Corruption Law. And for the UK Bribery Act, what’s interesting about it is that you have to have internal controls in place, it’s like mandatory to have the controls in place against corruption, whereas in China, it’s really only if there is an intent that’s proven that we can have a fine under Anti-Corruption Law.

But one thing that is key is that for all of them, we can go to jail. So it’s really important, you know, because there’s obviously there’s the money, like, there’s also personal fines, there’s like the fine, corporate fine, but there’s also personal fines. And there’s also people that actually get to go to jail. So we want to make sure as auditors that we help our people. And we’re going to help them to be protected.

Especially if you’re working in a big group, over here in Ho Chi Minh City, we have a lot of expat friends, you know, we have a lot of experts. So we know expats are really well before I was living in Shanghai, a lot of expat friends over there as well. And if you’re an expat, you get to know all the other expats that you get to know all the other foreigners that are living in a different country.

And when that happens, you get to know like the CEO of this place, the CFO of that place, you know, all these people, and you realise that they come and they stay for three years, or five years max, and then they’re gone. You know, they’re coming from the host country, they come over here, they stay and then they’re gone. And it’s very difficult for them, actually, because they’re coming into a situation where they have a team that’s already in place. And they don’t speak the language. And they don’t know that team. And they don’t know all those suppliers and customers and everything.if you’re working in a big group. I live over here in Ho Chi Minh City. And over here in Ho Chi Minh City, we have a lot of expat friends, you get to know like the CEO of this place, the CFO of that place, you know, all these people, and you realise that they come and they stay for three years, or five years max, and then they’re gone.

You know, they’re coming from the host country, they come over here, they stay in and they’re gone. And it’s very difficult for them, actually, because they’re coming into a situation where they have a team that’s already in place, and they don’t speak the language, and they don’t know that team, and they don’t know all those suppliers and customers and everything. But despite the fact they don’t know all that, they are legally liable, personally, for a criminal case against them.

That’s really concerning, you know, and I’ve actually met people in the past who’ve been working for some very big French companies in China in the past, or living in Shanghai, and working for CFO of those big groups. And at one point, they actually decided to take all of their C-level employees and put them into Hong Kong, because they didn’t even want to have them in the country, because it’s like, there’s so much corruption going on in the country. And especially in that particular industry they’re in, everyone is doing corruption in the industry, and it’s a known fact, right? And the same with FCPA, same with China Anti-Corruption Law, there is a whistleblower hotline, and you do get a reward if you report somebody.

So you just need a disgruntled employee, somebody who doesn’t like foreigners, or you know, you don’t know what you’re getting into, and they can report you on the hotline, and then you can find yourself in jail. And it’s like, you’re just responsible because you’re a C-level employee, but you know, you’re only there for three years. So as an internal auditor, it’s good to be able to sort of give people a heads up, you know, like, what’s the risk level of that entity in that country? Is it something like, does it seem to be a lot of corruption going on? Does it seem to be like, not much control and stuff like that? So if you’re an auditor, even if you’re not like implementing the controls, what you want to be able to do is you want to have a one-pager that’s going to tell you really fast whether or not there’s some huge issues going on, okay? And then obviously we are talking about big fines if we are a multinational company, and somebody’s coming along and fining us for FCPA, then it’s actually a big problem for the company, because they do get massive fines for FCPA.

And if you’re in a country, you get a fine for FCPA. You might be in China, you get a fine for FCPA, and then you also get a fine for the China anti-corruption law at the same time. So you get like a massive amount of fines. So these things can actually have a huge financial impact on the entity, and so as an auditor, we want to be able to help the people to know whether or not they’ve got a significant risk. We want to be able to help head office to know they are going to put CFO over there on an expat contract, and the CFO is going to be in a huge amount of risk. What we’re going to do about it, maybe we’re going to put them more over in Hong Kong, or we change the job title or something because depending on how much risk you’ve got.