Understand Corruption in Fraud Tree for fraud detection (Part 1/2)

How are we going to go about choosing the top 10 data analytics for fraud detection?

So as a certified fraud examiner myself, I would naturally just go online and look for the report to the nation is done every single year. But the report to the nation is very independent, you get an independent view. And they are telling us pretty much the same thing that they’ve been telling us over the last 10 years, I’ve been a fraud examiner.

And that is that asset misappropriation schemes are the most common. If we’re going to choose our top 10 data analytics, we’re going to choose things that happen like all the time, like really common ones is asset misappropriation. They are the most common, they’re 86% of cases.

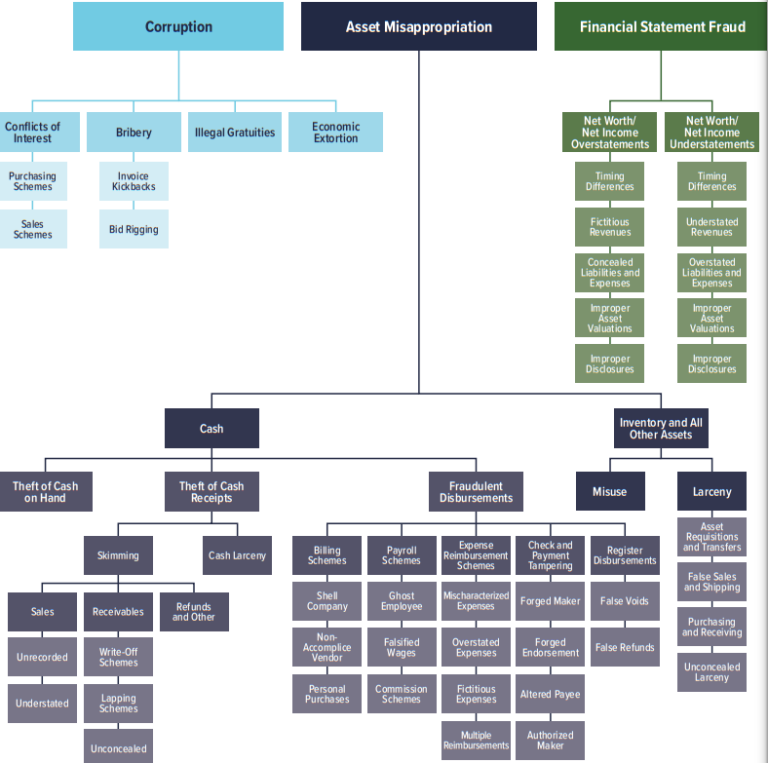

However, financial statement fraud schemes, which are harder to find, are 10% of cases, but they have a much higher loss associated with them. So if you are not that used to what is the fraud tree, I’ve put a little fraud tree down here. And basically, there are three branches of fraud trees.

The first one is corruption, they got asset misappropriation, and then financial statement fraud. And this is such a good framework to have in your mind if you’re thinking about fraud, like where to start, what to do in terms of fraud to get that for tree in your mind. And it really does help.

I recently, well, a few years back, I was working for one of our major customers. And they said to me, no, no, no, we don’t want to do anything to do with corruption, because corruption is not fraud. And I was just like, yes, it is. It is. It’s the first branch of the fraud tree. People often also say to me that, you know, you cannot detect corruption with data analytics.

And it’s true that it’s hard, because corruption is often under the table, it’s like the little envelope that you give someone to have a bribe and things like that. But what we need to remember is that corruption, the money for it, so if you’re going to pay a bribe, you’re going to pay a big bribe to a customer, you’re probably not going to get that money from your pockets, you’re going to get that money somehow out of the company. So corruption, we can detect indirectly, it’s a little bit complicated.

And basically, what we’re looking for is bribes. If it’s to do with kickbacks, it’s even more indirect, because we have to look at, do we give something special to a supplier, and then it’s only then that that supplier actually gives us a kickback, you know, so we’re looking for like, you know, do we let suppliers charge 10 times the amount and one of our customers had this recently, where they were actually the supplier was charging 10 times the normal amount. And luckily, they had a tip off for that.

And so they’re able to go into emails. And they found like all of the text discussion about, you know, OK, just add times 10 to the invoice, and then you can give me some back and all this kind of thing. So we can detect that indirectly.

When it comes to asset misappropriation, a little bit more easy. And when it comes to financial statement fraud schemes, it’s quite tricky because we have to have a really good knowledge of accounting. So that’s always something that’s a challenge.

So these things are not individual, they overlap each other. So if you’re doing some theft, say, for example, you’re going to steal a load of stuff out of the the warehouse or something like that, you’re going to need to maybe cover that up. And if you’ve got access to the general ledger, you might want to cover that up.

And financial statement fraud is a way that you might do that because you might enter some general entries to cover up those things. OK, so another way that we can decide what are the top 10 data analytics is maybe to think about, OK, what is what are the data analytics that actually going to help me to prevent fraud? Because to be honest, and the reporting nation says this, the most easy way, well, like the most common way for people to detect fraud is not for data analytics is actually through tips. OK, it’s through people who are saying, hey, my boss is frauding, you know, I don’t like him, so I’m going to I’m going to tell on him.

Right. So it’s actually quite hard to detect things through fraud. So we might be wanting to do data analytics to help prevent fraud.

And if we put in place a lot of data analytics, then we can actually help prevent about one third of frauds. This is what the Certified Fraud Examiner says. So you want to see, you know, what can you do in order to prevent fraud? And the Association of Certified Fraud Examiners say that the best method of prevention is the perception of detection.

OK, so if you are going to roll out a lot of data analytics and let people know that we are actually looking at things, let them know that we are going through the general ledger and we’re reviewing all the journal entries and it’s no longer going to be that needle in the haystack, 10 million dollar journal entry that no one notices.